Non-fungible tokens trading volumes on the BNB Chain saw a renewal in the 3rd quarter, increasing 283% to an everyday average of $600,400, according to blockchain analytics firm Messari.

The typical everyday sales likewise increased, up 47% quarter-on-quarter to 8,900, according to Messari’s Research study Supervisor “AJC.”

” Nevertheless, typical everyday purchasers were down 53% QoQ to 2,300, signifying that NFT activity in Q3 was driven by ‘whales’ instead of little users,” the Nov. 7 report mentioned.

Everyday typical NFT volume on BNB Chain because Oct. 2023. Source: Messari

BNB Chain’s $55.2 million NFT trading volume (determined by increasing the typical everyday volume by the variety of days in Q3) still fades in contrast to the Ethereum and Bitcoin networks, which tallied $120.7 million and $74.6 million in trading volume over the last thirty days alone, CryptoSlam information programs.

Solana, Mythos Chain, Polygon and Immutable have actually likewise seen more trading volume than the BNB Chain over the very same timeframe.

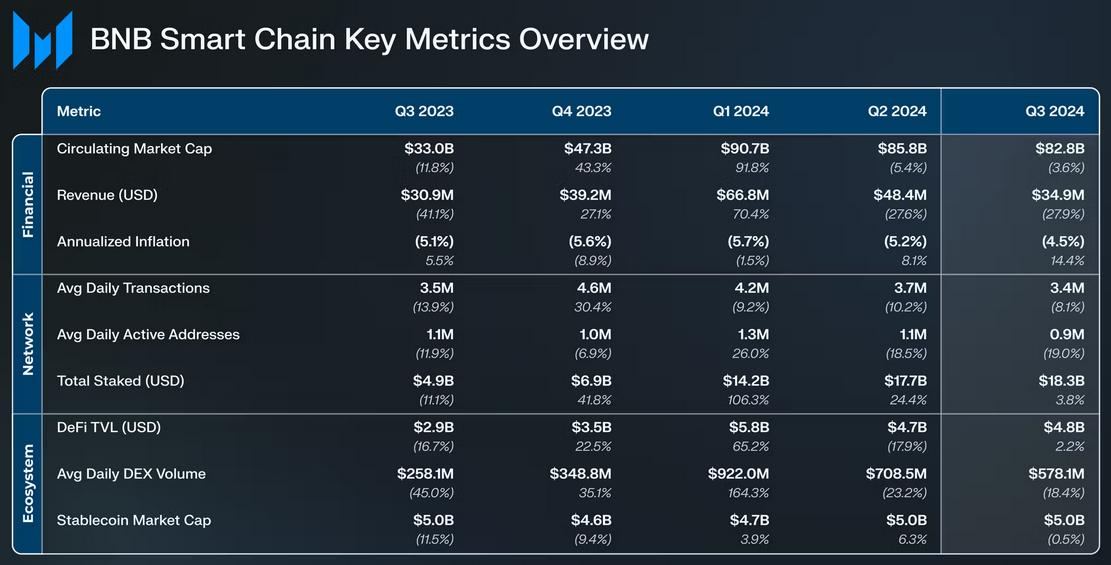

Other metrics explaining BNB Chain’s efficiency were blended.

BNB Chain’s profits toppled 27.9% quarter-on-quarter to $34.9 million, which was mostly credited to a 27% fall in gas charges paid on decentralized financing deals.

BNB Chain’s typical everyday active address likewise dropped 19% to 900,000 as typical everyday deals fell 8.1%.

Related: Dip in trading at Binance and other significant crypto exchanges puzzles professionals

Nevertheless, the overall worth locked on the BNB Chain increased 2.2% to $4.8 billion in Q3, with Algorithmic cash market procedure Venus Financing being the greatest factor to that increase, increasing 13% to $1.79 billion.

More BNB tokens were burned than minted in Q3– leading to a deflation rate of 4.5% and adding to a 2.5% rate increase as the more comprehensive market somewhat fell back, CoinGecko information programs.

Secret efficiency indications of the BNB Smart Chain in Q3 2024. Source: Messari

2 of the most typical usage cases for BNB Chain were negotiating with the Tether (USDT) stablecoin and engaging with the decentralized exchange PancakeSwap, Messari’s analysis revealed.

The BNB Chain was introduced by crypto exchange Binance in 2020, at first under the name Binance Smart Chain.

It boasts the 4th biggest TVL amongst layer-1 blockchains, routing just Ethereum, Solana and Tron, DefiLlama information programs.

On The Other Hand, BNB Chain revealed a brand-new real-world possession tokenization service that offers people and companies with a no-code option to tokenize real-world possessions in “minutes” previously today.

Binance employee behind the option claim it substantially decreases the expense, time and labor required to tokenize possessions, decreasing the barrier to entry for everybody.

Publication: Reality yield farming: How tokenization is changing lives in Africa