Traders considering U.S. retail giants like Amazon.com Inc. AMZN, Walmart Inc. WMT and Finest Purchase ahead of Black Friday and Cyber Monday might remain in for an undesirable surprise as December starts.

Regardless of the vacation shopping craze, historic information covering years recommends December is not the perfect month to buy these retail leviathans.

December Is (Not) One Of The Most Fantastic Time Of The Year For Walmart

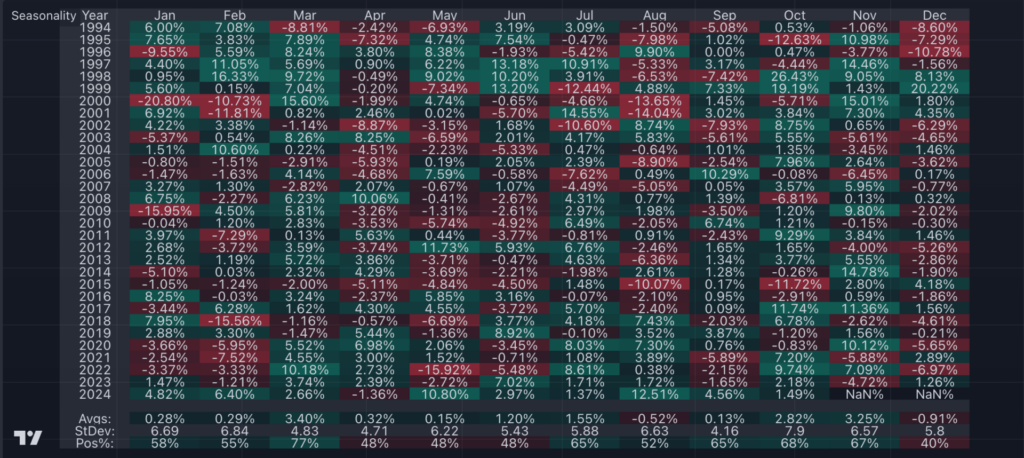

Over the last twenty years, December has actually been Walmart’s weakest month of the year.

Shares of Walmart fell by approximately 1.1% throughout the month, marking their worst typical month-to-month efficiency.

Contributing to the gloom, Walmart shares have just closed December in favorable area 40% of the time– simply 8 times in twenty years. This is the most affordable winning ratio for any month in the fiscal year.

The merchant’s worst December efficiency in current history took place in 2022, when Walmart shares toppled 7% throughout the month.

When extending the timeframe to thirty years, the information stays constant: December is still Walmart’s worst-performing month, with shares dropping 0.9% usually and keeping a winning ratio of simply 40%.

Read likewise: November Small-Cap Rise Might Bring Into December’s Santa Rally, Historic Trends Suggest

Amazon Likewise Sees Red In December

Amazon.com Inc. likewise tends to fail throughout the holiday. While the e-commerce giant does not post losses as high as Walmart’s, December ranks as Amazon’s second-worst month for stock efficiency, tracking just February.

Over the last twenty years, Amazon shares have actually fallen approximately 0.27% in December, with a winning ratio of simply 45%.

The worst December on record came just recently in 2022, when Amazon’s stock dropped by 13%, showing more comprehensive market turbulence.

Nevertheless, December hasn’t constantly been grim– Amazon saw some standout gains in the past, consisting of a 20.1% rally in 2008 and an 11.6% dive in 2004.

Why Do Amazon And Walmart Battle Throughout the Holidays?

Initially look, the holiday– a time of crazy shopping activity– may look like a benefit for retail stocks. However Wall Street financiers frequently avoid purchasing retail giants like Amazon and Walmart throughout this duration, and the factors come down to benefit margins.

Black Friday and Cyber Monday offers might improve profits, however they likewise weigh on revenue margins. The high discount rates required to bring in customers throughout the vacations frequently result in margin compression, a warning for financiers focusing on success.

The vacation duration is normally when expectations for retail efficiency are currently sky-high. If outcomes do not fulfill or go beyond those lofty criteria, stocks frequently sell-off.

Read Next:

Picture: Shutterstock

Market News and Data gave you by Benzinga APIs